Movable Partition Capital Allowances . learn how to claim tax deductible expenses for qualifying capital expenditure on properties and plant and machinery in ireland. learn about the tax relief for capital expenditure on industrial buildings or structures in ireland. capital allowances are a form of tax relief for capital expenditure incurred on certain assets. the general commissioners decided that the partitioning was “plant” and that the company was entitled to the allowances. one asset that has been found to be plant in case law and now mentioned in the capital allowances act (caa) 2001 is. it you get a claim that moveable partitions are plant you should check to see if they need to possess mobility as a matter of. Find out the definitions, types, conditions and limitations. Similar to depreciation, the relief is a write off of the.

from www.teachoo.com

one asset that has been found to be plant in case law and now mentioned in the capital allowances act (caa) 2001 is. Similar to depreciation, the relief is a write off of the. capital allowances are a form of tax relief for capital expenditure incurred on certain assets. Find out the definitions, types, conditions and limitations. learn about the tax relief for capital expenditure on industrial buildings or structures in ireland. learn how to claim tax deductible expenses for qualifying capital expenditure on properties and plant and machinery in ireland. it you get a claim that moveable partitions are plant you should check to see if they need to possess mobility as a matter of. the general commissioners decided that the partitioning was “plant” and that the company was entitled to the allowances.

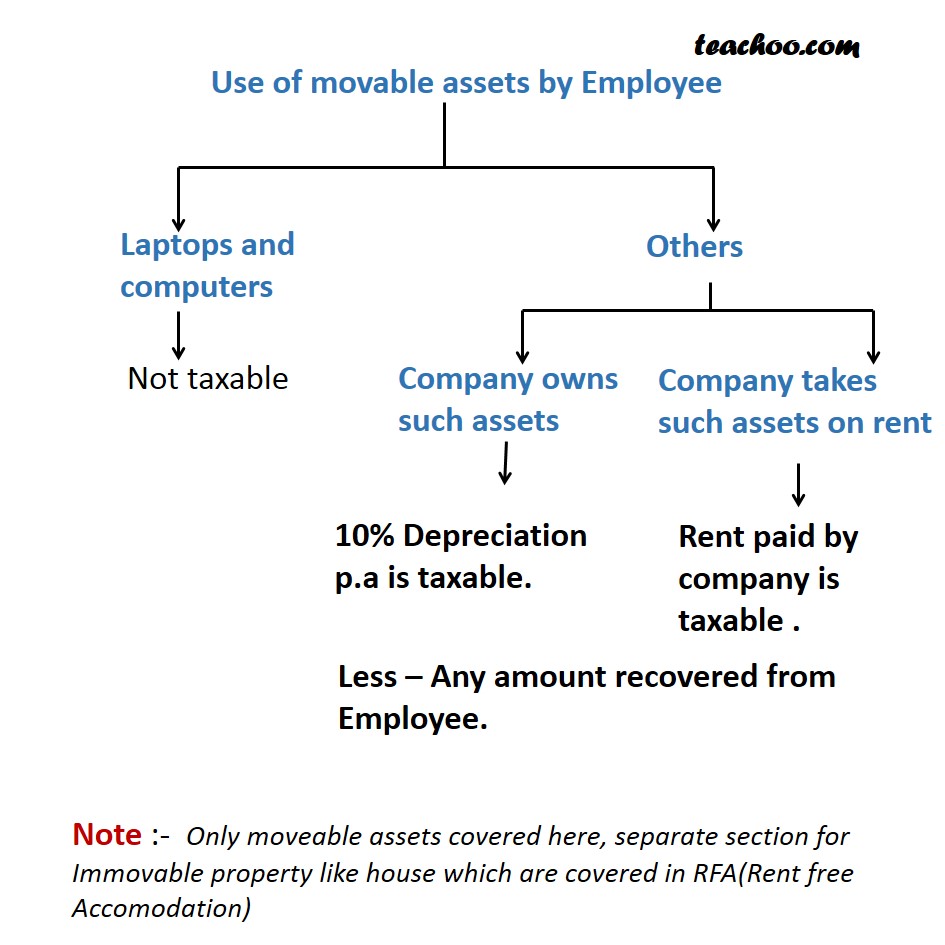

Use of movable assets by Employee Taxability of Perquisites

Movable Partition Capital Allowances the general commissioners decided that the partitioning was “plant” and that the company was entitled to the allowances. learn about the tax relief for capital expenditure on industrial buildings or structures in ireland. capital allowances are a form of tax relief for capital expenditure incurred on certain assets. one asset that has been found to be plant in case law and now mentioned in the capital allowances act (caa) 2001 is. the general commissioners decided that the partitioning was “plant” and that the company was entitled to the allowances. Find out the definitions, types, conditions and limitations. learn how to claim tax deductible expenses for qualifying capital expenditure on properties and plant and machinery in ireland. Similar to depreciation, the relief is a write off of the. it you get a claim that moveable partitions are plant you should check to see if they need to possess mobility as a matter of.

From www.google.com

Patent US8322095 Movable partitions and header assemblies for movable Movable Partition Capital Allowances learn how to claim tax deductible expenses for qualifying capital expenditure on properties and plant and machinery in ireland. Similar to depreciation, the relief is a write off of the. Find out the definitions, types, conditions and limitations. the general commissioners decided that the partitioning was “plant” and that the company was entitled to the allowances. it. Movable Partition Capital Allowances.

From www.propertycapitalallowance.com

The Concept of PEFFs Capital Allowance Review Service Movable Partition Capital Allowances one asset that has been found to be plant in case law and now mentioned in the capital allowances act (caa) 2001 is. Find out the definitions, types, conditions and limitations. learn how to claim tax deductible expenses for qualifying capital expenditure on properties and plant and machinery in ireland. Similar to depreciation, the relief is a write. Movable Partition Capital Allowances.

From www.teachoo.com

Use of movable assets by Employee Taxability of Perquisites Movable Partition Capital Allowances it you get a claim that moveable partitions are plant you should check to see if they need to possess mobility as a matter of. one asset that has been found to be plant in case law and now mentioned in the capital allowances act (caa) 2001 is. capital allowances are a form of tax relief for. Movable Partition Capital Allowances.

From www.tradeindia.com

Movable Partitions at 1200.00 INR in Mumbai, Maharashtra Vivan Movable Partition Capital Allowances Find out the definitions, types, conditions and limitations. capital allowances are a form of tax relief for capital expenditure incurred on certain assets. learn how to claim tax deductible expenses for qualifying capital expenditure on properties and plant and machinery in ireland. learn about the tax relief for capital expenditure on industrial buildings or structures in ireland.. Movable Partition Capital Allowances.

From www.ghanayello.com

Movable Partition Walls DALION ROYAL LIMITED Movable Partition Capital Allowances Similar to depreciation, the relief is a write off of the. it you get a claim that moveable partitions are plant you should check to see if they need to possess mobility as a matter of. capital allowances are a form of tax relief for capital expenditure incurred on certain assets. Find out the definitions, types, conditions and. Movable Partition Capital Allowances.

From www.egmovablewall.com

Customized Church Movable Wall Partition Manufacturers, Suppliers Movable Partition Capital Allowances the general commissioners decided that the partitioning was “plant” and that the company was entitled to the allowances. Find out the definitions, types, conditions and limitations. learn about the tax relief for capital expenditure on industrial buildings or structures in ireland. learn how to claim tax deductible expenses for qualifying capital expenditure on properties and plant and. Movable Partition Capital Allowances.

From www.propertycapitalallowance.com

Movable and Immovable capital allowances Capital Allowance Review Service Movable Partition Capital Allowances the general commissioners decided that the partitioning was “plant” and that the company was entitled to the allowances. learn about the tax relief for capital expenditure on industrial buildings or structures in ireland. one asset that has been found to be plant in case law and now mentioned in the capital allowances act (caa) 2001 is. Similar. Movable Partition Capital Allowances.

From www.propertycapitalallowance.com

Movable and Immovable capital allowances Capital Allowance Review Service Movable Partition Capital Allowances one asset that has been found to be plant in case law and now mentioned in the capital allowances act (caa) 2001 is. it you get a claim that moveable partitions are plant you should check to see if they need to possess mobility as a matter of. capital allowances are a form of tax relief for. Movable Partition Capital Allowances.

From div-mw.com

Movable Walls & Partitions Dividers Movable Partition Capital Allowances learn how to claim tax deductible expenses for qualifying capital expenditure on properties and plant and machinery in ireland. one asset that has been found to be plant in case law and now mentioned in the capital allowances act (caa) 2001 is. the general commissioners decided that the partitioning was “plant” and that the company was entitled. Movable Partition Capital Allowances.

From www.studocu.com

Capital Allowances Notes Group 1 MOVABLE ASSETS Can be moved Movable Partition Capital Allowances the general commissioners decided that the partitioning was “plant” and that the company was entitled to the allowances. Find out the definitions, types, conditions and limitations. Similar to depreciation, the relief is a write off of the. learn about the tax relief for capital expenditure on industrial buildings or structures in ireland. it you get a claim. Movable Partition Capital Allowances.

From madanca.com

Year End Tax Planning Tips for Business Owners (2019) Madan CA Movable Partition Capital Allowances the general commissioners decided that the partitioning was “plant” and that the company was entitled to the allowances. Similar to depreciation, the relief is a write off of the. capital allowances are a form of tax relief for capital expenditure incurred on certain assets. one asset that has been found to be plant in case law and. Movable Partition Capital Allowances.

From ccs-co.com

Capital Allowance When a setting is Plant Moveable Partitions CCS Movable Partition Capital Allowances learn about the tax relief for capital expenditure on industrial buildings or structures in ireland. one asset that has been found to be plant in case law and now mentioned in the capital allowances act (caa) 2001 is. it you get a claim that moveable partitions are plant you should check to see if they need to. Movable Partition Capital Allowances.

From ccs-co.com

Capital Allowance When a setting is Plant Moveable Partitions CCS Movable Partition Capital Allowances it you get a claim that moveable partitions are plant you should check to see if they need to possess mobility as a matter of. learn how to claim tax deductible expenses for qualifying capital expenditure on properties and plant and machinery in ireland. Similar to depreciation, the relief is a write off of the. Find out the. Movable Partition Capital Allowances.

From partitionwall.en.made-in-china.com

China Movable Partition Walls Room Divider on Wheels for Restaurant Movable Partition Capital Allowances learn how to claim tax deductible expenses for qualifying capital expenditure on properties and plant and machinery in ireland. one asset that has been found to be plant in case law and now mentioned in the capital allowances act (caa) 2001 is. the general commissioners decided that the partitioning was “plant” and that the company was entitled. Movable Partition Capital Allowances.

From www.claritaxbooks.com

Capital Allowances 202324 Claritax Books Movable Partition Capital Allowances learn about the tax relief for capital expenditure on industrial buildings or structures in ireland. Similar to depreciation, the relief is a write off of the. learn how to claim tax deductible expenses for qualifying capital expenditure on properties and plant and machinery in ireland. it you get a claim that moveable partitions are plant you should. Movable Partition Capital Allowances.

From www.linkedin.com

Types of Capital Allowances & Their Regulation Movable Partition Capital Allowances Similar to depreciation, the relief is a write off of the. learn about the tax relief for capital expenditure on industrial buildings or structures in ireland. capital allowances are a form of tax relief for capital expenditure incurred on certain assets. one asset that has been found to be plant in case law and now mentioned in. Movable Partition Capital Allowances.

From www.soundwin-fs.com

SW65 Movable Partition Soundwin Acoustics Movable Partition Capital Allowances the general commissioners decided that the partitioning was “plant” and that the company was entitled to the allowances. it you get a claim that moveable partitions are plant you should check to see if they need to possess mobility as a matter of. one asset that has been found to be plant in case law and now. Movable Partition Capital Allowances.

From www.pinterest.ph

partitionmovable partitionmovable wallsliding partitionmovable wall Movable Partition Capital Allowances the general commissioners decided that the partitioning was “plant” and that the company was entitled to the allowances. learn about the tax relief for capital expenditure on industrial buildings or structures in ireland. Find out the definitions, types, conditions and limitations. it you get a claim that moveable partitions are plant you should check to see if. Movable Partition Capital Allowances.